All Categories

Featured

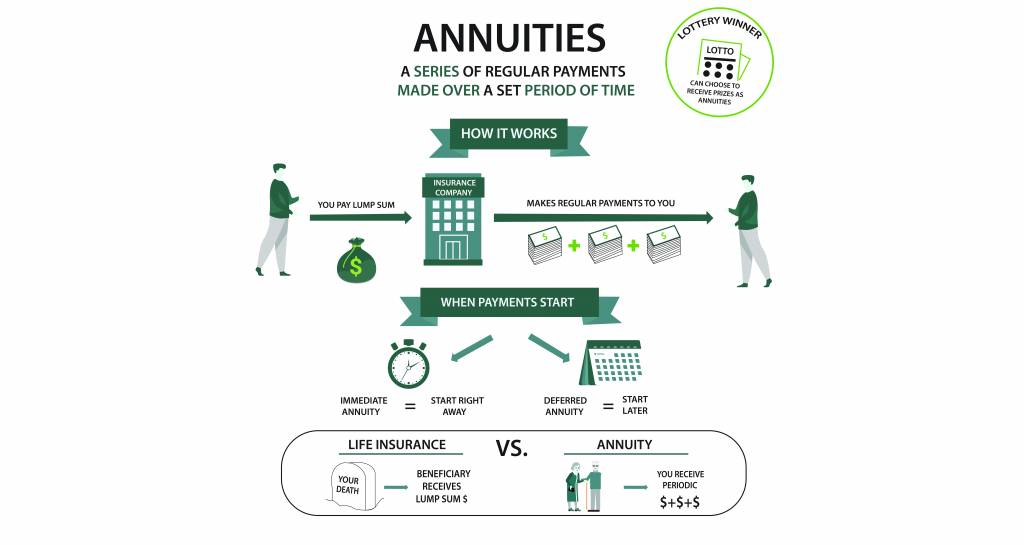

The very best selection for any kind of person must be based on their existing circumstances, tax situation, and economic goals. Retirement annuities. The cash from an inherited annuity can be paid as a single round figure, which comes to be taxable in the year it is received - Annuity income. The downside to this alternative is that the profits in the contract are distributed initially, which are tired as common revenue

If you do not have an immediate need for the cash money from an acquired annuity, you could pick to roll it into an additional annuity you manage. With a 1035 exchange, you can guide the life insurance provider to transfer the cash from your acquired annuity into a brand-new annuity you develop. If the inherited annuity was originally established inside an IRA, you might trade it for a certified annuity inside your own IRA.

Annuity beneficiaries can be contested under particular scenarios, such as conflicts over the credibility of the recipient classification or insurance claims of undue impact. An annuity death benefit pays out a set amount to your recipients when you die. Joint and recipient annuities are the two types of annuities that can stay clear of probate.

Latest Posts

Decoding Choosing Between Fixed Annuity And Variable Annuity Everything You Need to Know About What Is A Variable Annuity Vs A Fixed Annuity Defining Indexed Annuity Vs Fixed Annuity Benefits of Choos

Analyzing Strategic Retirement Planning Key Insights on Your Financial Future What Is the Best Retirement Option? Pros and Cons of Various Financial Options Why Annuities Fixed Vs Variable Matters for

Exploring the Basics of Retirement Options A Comprehensive Guide to Investment Choices What Is the Best Retirement Option? Advantages and Disadvantages of Different Retirement Plans Why Retirement Inc

More

Latest Posts